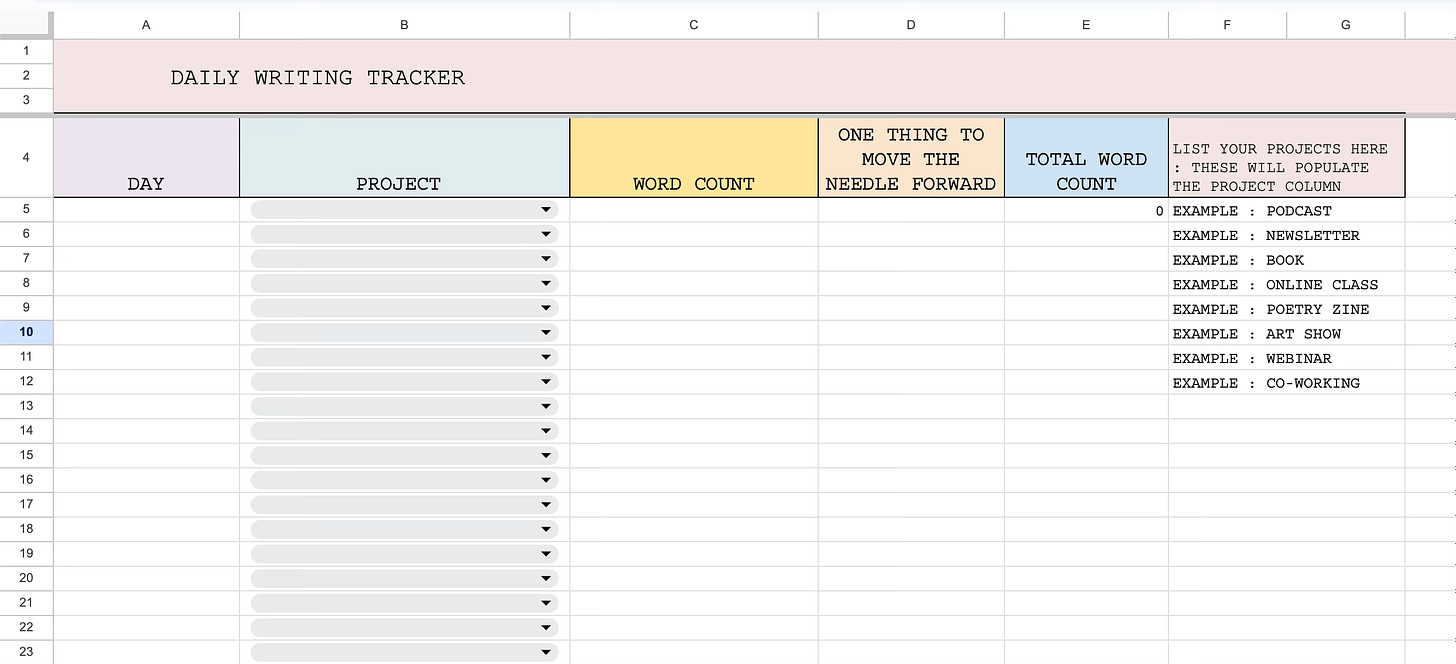

To begin today I want to share with you a free Daily Writing Tracker I have been using in the early mornings of Landscapes to track my progress on my newsletter essays and my next book. Landscapes meets this month at its normal time of Tue/Thu 11-1EST and also M-F 5:30-7:30amEST Dec 2- 20

That’s right! Three weeks of our Early Morning Writing Retreat are in session. Quiet mornings before the sun comes up.

The daily writing tracker also includes prompts to get you closer to knowing what it is you want to write about, organize your ideas, and more. It’s a bit of a sneak peek into the more robust google sheet template we will be using together in Week One of Writing the Personal - the class I am teaching with

and that starts this upcoming Sunday December 8 and runs through December 22 when the light returns.The tracker is also great if you want to do an advent sort of writing challenge for yourself, like twenty days of writing every day leading up to the Solstice.

A little over two weeks ago I mapped out a spending ban for myself to take part in through the end of the year. To say this assignment has changed me would be almost too light. I have been truly transformed in a way I did not expect. I was tempted to not even start because I feared that I would fail, alas, I carried on.

An Acknowledgment

Talking about money is really hard and weird. I ask that you read this in your own energetic sovereignty and apply what works and leave the rest. Perhaps you are struggling to make rent this month, or you are a millionaire with a strong investment portfolio. I admire and acknowledge that my readers are coming at this from all different angles. What I know is that at any income bracket we can experience chaotic spending and not having systems in place. You can always start sweeping up the mess today, even if it is in small ways.

What is a spending ban?

A spending ban (also known as a spending fast, a spending diet, a no spend challenge : find the words that are right for you) is a pre determined amount of time where you will not buy certain things that fall outside of necessities.

It is generally recommended to try this for a minimum of 1-3 months, but of course you could test it over a weekend if you wanted to. My plan is to revaluate at the end of the year and continue the spending ban for all of next year. One of my tweaks is I have an interest in taking the Trauma of Money course this Spring and I want to see if I can work it into my spending plan. Thank you to those of you who suggested it to me.

Why do a spending ban?

For me the spending ban emerged when I hit bottom and at my therapist’s insistence read the book Spent: Break the Buying Obsession and Discover Your True Worth, which incorporates many of the principles of Debtors Anonymous and healing patterns of money addiction.

While many things lead me to this bottom, a place I have been before, no solution was making its way through my brain until I read this book. It just clicked everything into place for me. I love god and twelve step language so it really rang true, although it doesn’t lean too heavily into those places. I also asked a friend to read it with me, this was a big step : Both in asking for support and having the accountability to check in with someone else about what it was bringing up.

The spending ban was out of a desire to pay down my debt, get caught up with back taxes, and start saving for the first time ever. I had become a high earner for a self employed artist but was still living paycheck to paycheck and this was both embarrassing and outside of my values. I had experienced lifestyle creep, spending addiction, and mismanagement of my money.

Today I have robust spreadsheets, clear systems, a bookkeeper and accountant that are attentive and helpful, and friends and fellows who I can share my struggles with without fear of shame or judgement.

While I still have so much debt and a long way to go, my anxiety is in a new and different place having these systems set up.

Even a one month spending ban is a way to get clear on what your values are, take a cold hard look at where your money is going, and find out more about yourself in the process.

Making a spending plan will help you get clear on your needs vs wants list, something only you can define for yourself.

Making a spending plan

Part of a spending ban is also making a spending plan. I did this by doing all of my categorizing by hand line by line in YNAB for at least three months. I was so eager that to speed the process up I went back through three months of bank statements and entered everything in. This way you can get a really clear sense of what is coming in and what is going out. You can also do this by hand in a ledger, using google sheets, or any other money tracking app that suits you. Pick what makes sense to YOU, not what other people are doing. This was really important for me.

I made my spending plan based on my enough number, something I learned about from

- who I continue to deeply credit for much of my money support and healing. (They are also the guest on Common Shapes this week!!!)My current spending plan doesn’t include things like travel, which I will need to adjust a bit for next year. I just ran my numbers for November and am happy to say I was literally within $1 of my personal spending plan. This is a huge accomplishment for me. My business and tax numbers need a little bit of tweaking but I have come to accept the spending plan will always need some tweaking, especially as I am learning my own new systems.

The spending ban started part way through the month, so I am even more excited to see how much I can save and put toward my debt for December.

My advice is to keep your categories simple when starting out, but if you are like NO I want to be very specific and have a category just for Zoom, that could work for you too! Again - it’s so important to make this work so that you’ll actually do it.

Decide what goes and what stays

There are clear needs : food, shelter, transportation, insurance, dog food, etc. I decided I would continue to take my meds and pay for therapy, things that keep me alive. You know what you need to stay.

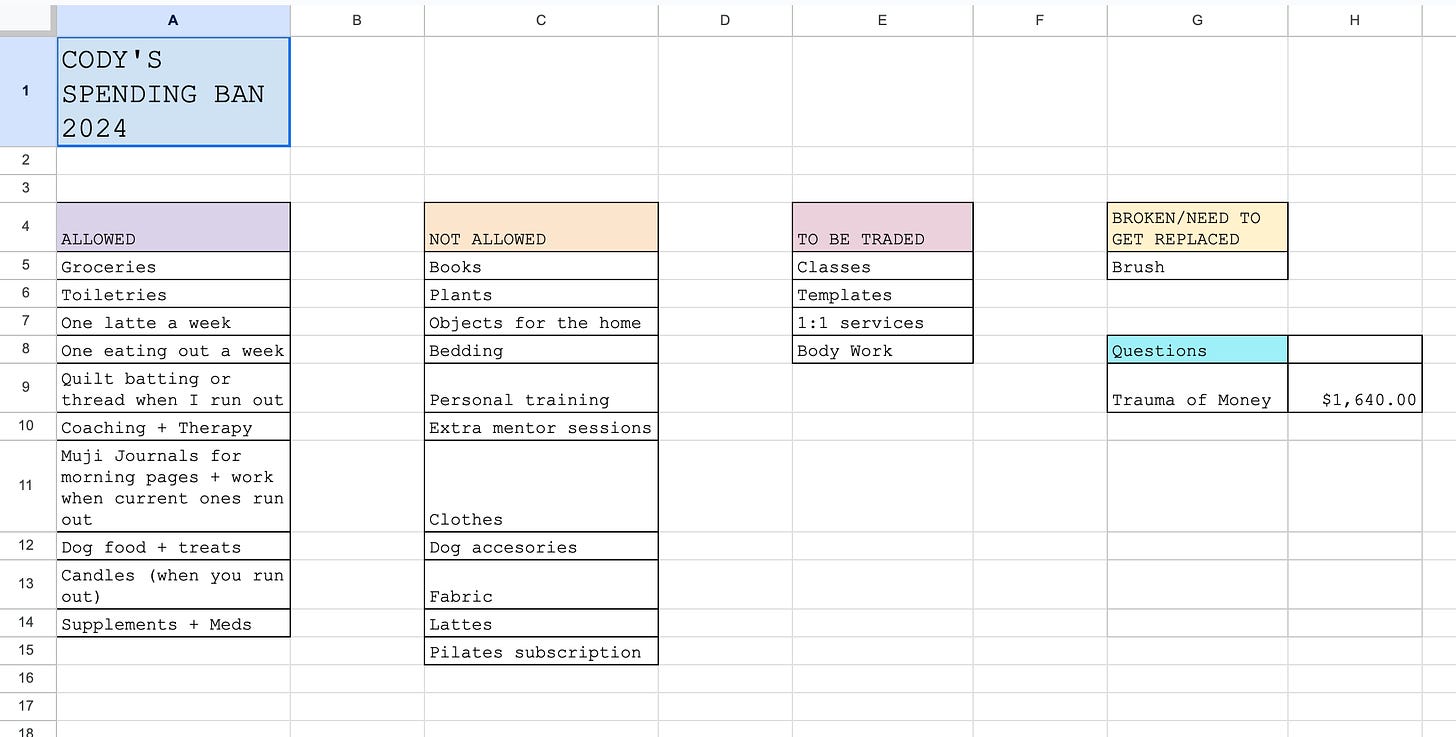

What was clearest in my no spend categories were : No books, no plants, no clothes, no home decor. Those are my four biggest shopping triggers. One of the last things I bought before the spending ban was a Kindle which has been so helpful in getting library books straight to the device.

I made three categories in a spreadsheet : ALLOWED, NOT ALLOWED, ALLOWED TO TRADE. I also made a “questions” category and require things to sit there for a minimum of one night if not a few weeks. That is currently where Trauma of Money is sitting being considered to purchase.

The Allowed List is a bit longer per my spending plan spreadsheet but these were things more that could fall under wants I wanted to be clear I would allow for myself.

So far I haven’t slipped once on my spending ban, and Black Friday didn’t even test me that much. I did unsubscribe from a few of my favorite shop’s newsletters and that felt good. Those Online Ceramics new drop texts will really get me window shopping.

Gift economy, trading, and spending hacks

One of the most delightful parts of the spending ban is that it hasn’t stopped me from acquiring things I desire outside of my spending plan - many of them cold pitches with people I don’t have pre existing relationships with.

Things I am trading people for for Writing the Personal :

Guest teaching at Landscapes

Private Spanish Lessons

Somatic coaching session

Ceramics

Things I am trading for with my own services :

A workshop

A spreadsheet template

Other 1:1 sessions

Sending my book to a friend who also just put a book out and is sending it to me

I also believe in the magic of passing a gift on. For instance I had a colleague teach in Landscapes as a trade for a 1:1 Creative Advising session, but instead of taking the session for herself she passed it on to someone else. Magic!

One hack I did was used an old email address to start a new Audible account and got two free credits. I also went through and lowered a bunch of my bills using my Naropa student ID! Spotify is now only 5.99/mo and Hulu is 1.99. I also lowered my phone bill. These are things on my want list that stayed in the spending ban. My playlists and my shows are a big part of my quality of life and a minimal enough cost a month that I decided to keep them.

Using Hoopla I get to borrow four audio books a month for free and Libby lets me borrow five Kindle books at a time. And then of course regular library book checkouts. And now Spotify Premium gives you 15 hrs of audiobook listening a month (huge!)

I am also sinking my teeth into a lot of old audio books I read before but didn’t fully understand yet because I didn’t have my money systems in place.

More on some of my exact money systems here :

Some of the books I read this week to continue my financial independence inspiration

⚬ Work Optional : Retire Early the Non-Penny-Pinching Way by Tanja Hester

⚬ I Survived Capitalism and All I Got Was This Lousy T-Shirt: Everything I Wish I Never Had to Learn about Money by Madeline Pendleton

⚬ The Art of Money: A Life-Changing Guide to Financial Happiness by Bari Tessler

⚬ The Spender's Guide to Debt-Free Living: How a Spending Fast Helped Me Get from Broke to Badass in Record Time by Anna Newell Jones

Gift Guides and Black Friday :

For the most part I try to stay off Substack Notes as I don’t currently participate in any social media, but when I login to write my little newsletter I noticed this year everyone has a gift guide. I only clicked through on one and it almost got me to buy some fabric, but I took a deep breath and paused and stayed committed to the spending fast and pictured just how much fabric I already have. Plus it’s very clearly written in the NOT ALLOWED category in my spreadsheet.

Having everything clearly mapped out in the spreadsheet has been a huge asset to this experiment.

Another rule on my spending ban is : drum roll please : no more Target. Target is a huge trigger for me. Both in my money story all the way back to childhood to now. It is a place I overspend and they gave me a credit card. I am happy to share I paid off that credit card this week and threw it away! It is the prettiest place to buy toilet paper, but I can also get that at any old CVS, a place that does not delight me in the same ways. When I was reading Work Optional this was also one of Tanja Hester’s triggers and that made me feel much less alone.

Another strange experience was that I go to Costco twice a year - to get my winter tires put on and taken off. I scheduled my appointment for the day after Black Friday, not considering I would be beholden to this store for two hours on a day filled with sales. The good thing is that Costco deeply stresses me out so I brought my noise cancelling headphones (thank you for the tip

) and sat with my pizza slice in the corner and knit the whole time. I did one lap around the store to get some steps in and the Apple Watches caught my eye. Hmmm maybe I would be on my phone less if it was on a watch? I walked away unscathed.Also I have noticed the boys who work at the tire department at Costco are extremely hot, I don’t make the rules!

No holiday gifts :

My family members aren’t huge gift givers but we usually thrift little things or make each other objects for the holidays. I let my family know I wouldn’t be buying gifts this year but I would love to make some food. I watched this give permission to my family to share their own desires - my dad stating that he did not want to cook at all this year and wanted me and my brother to. I feel like it is easy for our family to just sort of “figure it out” when we’re all together. It felt like such a loving request for him to say - ok if you’re going to say what you want I would like to say what I want.

I have plenty of pot holder making materials if I change my mind and want to make some gifts.

Being off Instagram :

I think that social media has been a huge part of my consumerism addiction, lifestyle creep, and quick purchasing actions. Being deactivated during my spending ban has been a huge help and blessing of not seeing very many sales at this time.

I think it can be another embarrassing thing to feel like Instagram has its hold on me but, it does. And the more honest I am about how it continues to affect me the better I feel.

Going forward :

Some considerations going forward would be adding a travel budget to my January spending plan as I’ll be guest teaching at Bates College for a few days at the end of January and traveling to Boulder for school in March. I’ll need to add some line items for eating out and I’m also considering allowing myself one book at a bookstore when in another city. This is a huge piece of being a writer for me - I love scouring a new bookstore and seeing what sparks my fancy. I am going to spend the next month leaning into how this feels or if it goes against my hopes for the spending ban.

Filling the Time :

Something that the spending ban and no longer being on social media has given me is : Time. Not just time but the spaciousness to fill my time with less stress. I have been wanting to find something outside of my work to put my energy toward and I live across from a horse farm and look at horses every day when I walk June. Sadly this horse farm flies their Trump flag high, but a friend who is a holistic vet and chiropractor told me about another farm around the corner from my house : Sea2Stable. From walking by horses every day I got it in my head I needed to be touching horses and hanging out with them.

I have my first official shift there Wednesday morning where I’ll learn to clean up the barn and do chores and eventually be trained in giving energetic healing to the traumatized horses who are being rehabilitated at the same time that they are paired with at risk kids who could use the bond of a horse to heal their nervous systems.

I don’t know anything about horses and they kind of scare the shit out of me but Wendy told me I would get the hang of it. I brushed Shrubs for awhile when I went for my visit last week and he has two different color eyes and is a baby and massive and perfect.

Transformation :

I have felt my relationships strengthen, my values get clearer, and the number in my bank account grow. I have a lot of fear and doubt still but I take it all one day at a time.

I feel less anxious and more present. I feel more excited about school and less distracted by packages coming to the door. I am walking and outside more than ever and consuming less.

I have even less desire to use social media for my business or personally, and I am feeling my mood improve in ways I did not expect.

There is so much mystery to life and so much out of our control, it feels amazing to regain some of the unknown with clear and sharp systems and rules. I am clear on what I am devoted to, which leads me to greater discipline.

I do my books in YNAB first thing every morning after I sit down with my coffee and light my candle. The coffee stacks on the match strike which stacks on the candle being lit which stacks onto opening YNAB and my bank account and my spreadsheet. No negotiating! Once this is finished I turn toward my writing with ease and pleasure.

I feel like a baby horse in my own ways, unsteady legs learning to walk, figuring out how to be a part of the herd. The lessons are their own gifts and I am grateful.

Thank you for coming on this journey with me today. I’d love to hear in the comments if you have ever done a no spend challenge or a spending fast of your own, what systems have worked for you, or what sorts of things are up for you right now with money!

Book a 1:1 Creative Advising call

info@codycookparrott.com

PO Box 252 Cedar, MI 49621

Landscapes : A writing group for all genres

If you loved today’s essays and want to lean into writing about your own life I’d love to invite you to Writing the Personal Dec 8-22 taught by myself,

andI am so excited for class this weekend, for being in the room together, for finding our ways through the personal and political and poetic. To weave in our values and reframe what it means to write about the self. I’d love to see you there.

All last weekend my sister kept saying "my grass is green enough," so that in combination with this newsletter has me reevaluating some things! I do want to use the things I have (books, candles, fabric, craft supplies, journals) before getting new ones.

Reading this made me cry? A question because that surprised me, and sparked some inquiry I've been avoiding. Thank you for your generous sharing as ever. xx